Todays Important Key Figures 14 Jan

Today’s important economic data releases – a snapshot of key indicators influencing markets and shaping financial expectations.

January 14, 2026 a 07:00 pm

EL: Fundamental Ratio Analysis - The Estée Lauder Companies Inc

EL: Evaluation of key financial ratios, analyst ratings, and price targets. A data-driven perspective on the valuation and market expectations.

January 14, 2026 a 06:00 pm

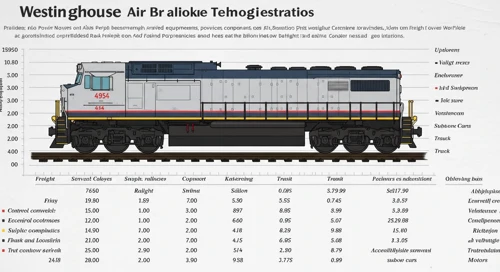

WAB: Analysts Ratings - Westinghouse Air Brake Technologies Corporation

WAB: Comprehensive breakdown of current and historical analyst ratings, offering insights into how expert sentiment has evolved over time.

January 14, 2026 a 05:00 pm

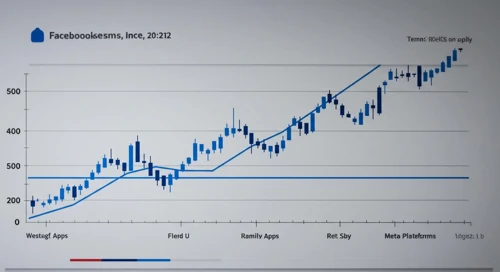

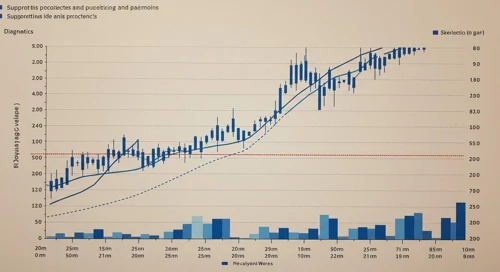

META: Fibunacci Level Technical Analysis - Meta Platforms Inc

META: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 14, 2026 a 04:44 pm

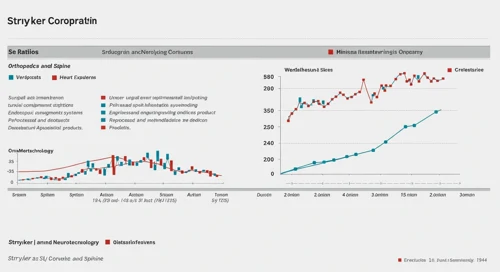

SYK: Analysts Ratings - Stryker Corporation

SYK: Comprehensive breakdown of current and historical analyst ratings, offering insights into how expert sentiment has evolved over time.

January 14, 2026 a 04:38 pm

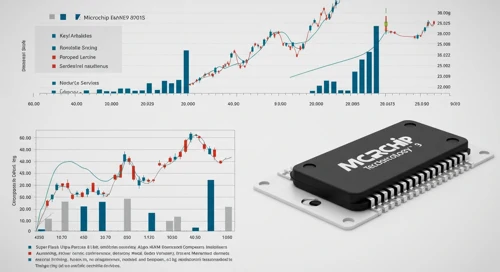

MCHP: Fundamental Ratio Analysis - Microchip Technology Incorporated

MCHP: Evaluation of key financial ratios, analyst ratings, and price targets. A data-driven perspective on the valuation and market expectations.

January 14, 2026 a 03:43 pm

DUK: Dividend Analysis - Duke Energy Corporation

DUK: In-depth analysis of a company's dividend stability and key fundamental ratios to assess its financial strength and long-term investment potential.

January 14, 2026 a 03:31 pm

Todays Important Key Figures 15 Jan

January 14, 2026 a 11:00 pm

BALL: Analysts Ratings - Ball Corporation

January 14, 2026 a 09:01 pm

PM: Analysts Ratings - Philip Morris International Inc

January 14, 2026 a 08:38 pm

HAL: Fundamental Ratio Analysis - Halliburton Company

January 14, 2026 a 07:43 pm

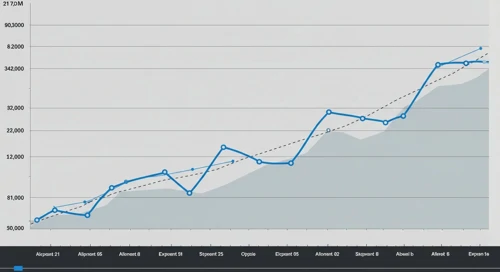

Consumer Cyclical Comparison. 14 Jan

Comparison of Consumer Cyclical. Where is strength and weakness? What has developed well and badly?

January 14, 2026 a 03:31 pm

KKR: Fibunacci Level Technical Analysis - KKR and Co Inc

KKR: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 14, 2026 a 03:15 pm

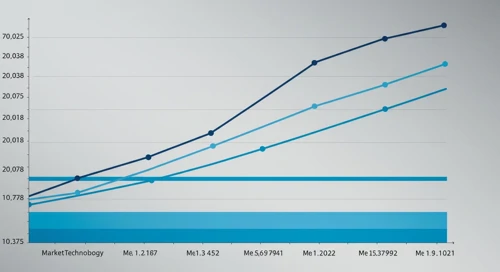

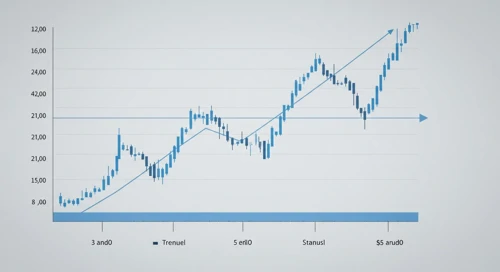

UHS: Trend with Support and Resistance Levels - Universal Health Services Inc

UHS: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 14, 2026 a 02:03 pm

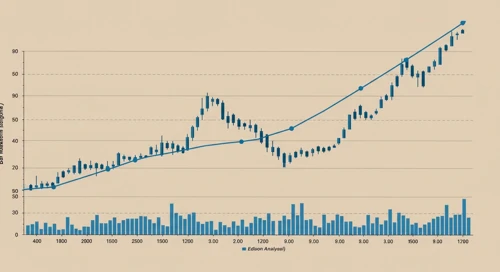

EIX: Trend with Support and Resistance Levels - Edison International

EIX: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 14, 2026 a 01:15 pm

NTAP: Fundamental Ratio Analysis - NetApp Inc

NTAP: Evaluation of key financial ratios, analyst ratings, and price targets. A data-driven perspective on the valuation and market expectations.

January 14, 2026 a 01:00 pm

HIG: Dividend Analysis - The Hartford Financial Services Group Inc

HIG: In-depth analysis of a company's dividend stability and key fundamental ratios to assess its financial strength and long-term investment potential.

January 14, 2026 a 12:46 pm

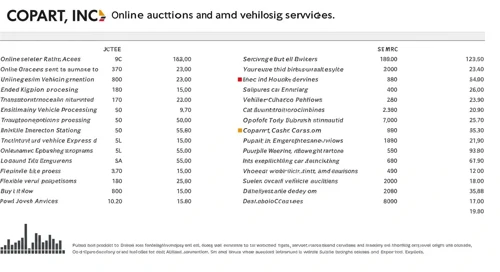

CPRT: Analysts Ratings - Copart Inc

CPRT: Comprehensive breakdown of current and historical analyst ratings, offering insights into how expert sentiment has evolved over time.

January 14, 2026 a 12:38 pm

Stock Market - Heatmap

Use mouse wheel to zoom in and out. Click a ticker to display detailed information in a new window. Hover mouse cursor over a ticker to see more data.

Stock's

AON: Analysts Ratings - Aon plc

AON: Comprehensive breakdown of current and historical analyst ratings, offering insights into how expert sentiment has evolved over time.

January 14, 2026 a 09:01 am

EBAY: Analysts Ratings - eBay Inc

EBAY: Comprehensive breakdown of current and historical analyst ratings, offering insights into how expert sentiment has evolved over time.

January 14, 2026 a 08:38 am

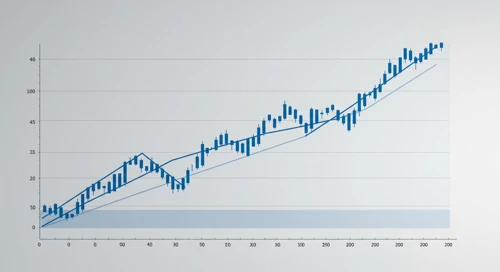

RCL: Trend with Support and Resistance Levels - Royal Caribbean Cruises Ltd

RCL: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 14, 2026 a 08:15 am

ISRG: Fundamental Ratio Analysis - Intuitive Surgical Inc

ISRG: Evaluation of key financial ratios, analyst ratings, and price targets. A data-driven perspective on the valuation and market expectations.

January 14, 2026 a 08:00 am

KLAC: Dividend Analysis - KLA Corporation

KLAC: In-depth analysis of a company's dividend stability and key fundamental ratios to assess its financial strength and long-term investment potential.

January 14, 2026 a 07:46 am

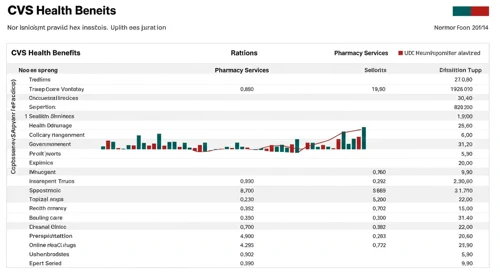

CVS: Fundamental Ratio Analysis - CVS Health Corporation

CVS: Evaluation of key financial ratios, analyst ratings, and price targets. A data-driven perspective on the valuation and market expectations.

January 14, 2026 a 07:43 am

MAR: Fibunacci Level Technical Analysis - Marriott International Inc

MAR: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 14, 2026 a 06:44 am

ES: Fibunacci Level Technical Analysis - Eversource Energy

January 14, 2026 a 11:44 am

DUK: Fundamental Ratio Analysis - Duke Energy Corporation

January 14, 2026 a 11:43 am

NDAQ: Fibunacci Level Technical Analysis - Nasdaq Inc

January 14, 2026 a 10:15 am

CMG: Trend with Support and Resistance Levels - Chipotle Mexican Grill Inc

January 14, 2026 a 09:03 am

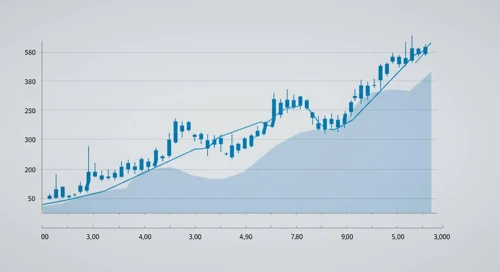

WMT: Fibunacci Level Technical Analysis - Walmart Inc

WMT: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 14, 2026 a 05:15 am

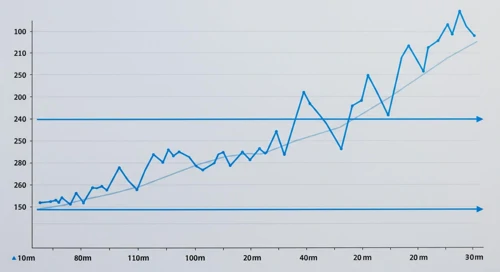

AMZN: Trend with Support and Resistance Levels - Amazoncom Inc

AMZN: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 14, 2026 a 04:03 am

HOLX: Trend with Support and Resistance Levels - Hologic Inc

HOLX: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 14, 2026 a 03:15 am

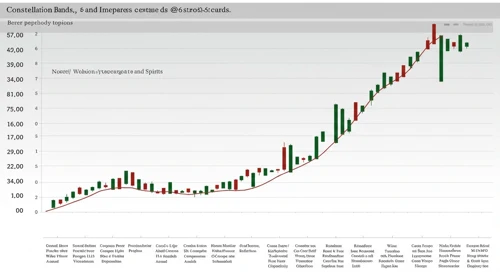

STZ: Analysts Ratings - Constellation Brands Inc

STZ: Comprehensive breakdown of current and historical analyst ratings, offering insights into how expert sentiment has evolved over time.

January 13, 2026 a 09:00 pm

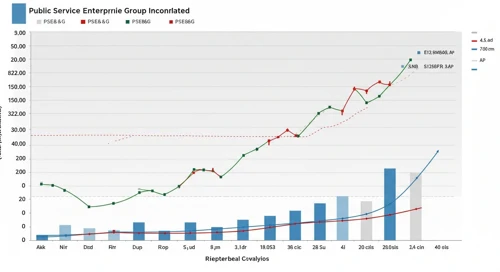

PEG: Analysts Ratings - Public Service Enterprise Group Incorporated

PEG: Comprehensive breakdown of current and historical analyst ratings, offering insights into how expert sentiment has evolved over time.

January 13, 2026 a 08:39 pm

IBM: Fundamental Ratio Analysis - International Business Machines Corporation

IBM: Evaluation of key financial ratios, analyst ratings, and price targets. A data-driven perspective on the valuation and market expectations.

January 13, 2026 a 07:43 pm

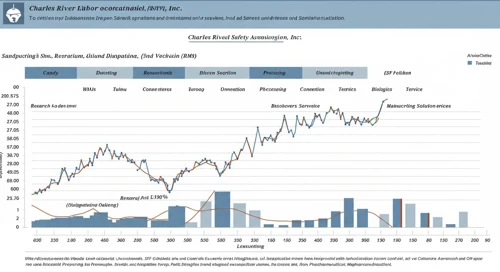

CRL: Fundamental Ratio Analysis - Charles River Laboratories International Inc

CRL: Evaluation of key financial ratios, analyst ratings, and price targets. A data-driven perspective on the valuation and market expectations.

January 13, 2026 a 06:00 pm

Economic Calendar

Currencies

Todays Important Key Figures 12 Jan

Today’s important economic data releases – a snapshot of key indicators influencing markets and shaping financial expectations.

January 12, 2026 a 07:00 pm

AUDCAD: Fibunacci Level Technical Analysis

AUDCAD: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 12, 2026 a 05:08 am

EURCHF: Trend with Support and Resistance Levels

EURCHF: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 12, 2026 a 04:28 am

GBPSEK: Fibunacci Level Technical Analysis

GBPSEK: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 11, 2026 a 05:08 am

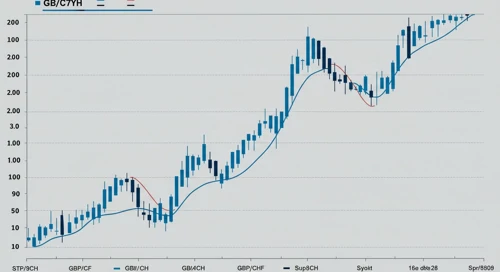

GBPCHF: Trend with Support and Resistance Levels

GBPCHF: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 11, 2026 a 04:28 am

AUDNZD: Fibunacci Level Technical Analysis

AUDNZD: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 10, 2026 a 05:08 am

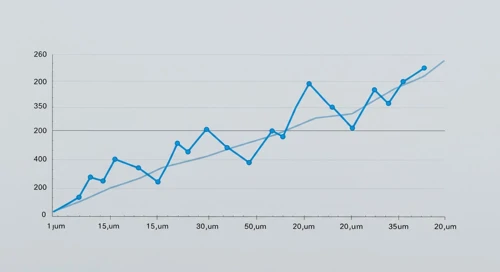

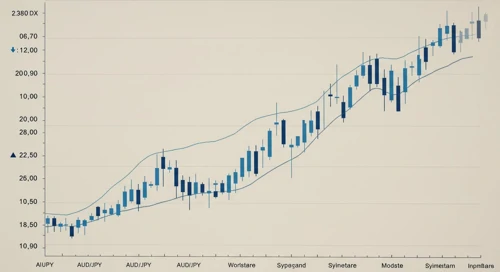

AUDJPY: Trend with Support and Resistance Levels

AUDJPY: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 10, 2026 a 04:28 am

EURGBP: Fibunacci Level Technical Analysis

January 14, 2026 a 05:08 am

Todays Important Key Figures 13 Jan

January 13, 2026 a 07:00 pm

USDJPY: Fibunacci Level Technical Analysis

January 13, 2026 a 05:08 am

Important Key Figures of the last Days

January 13, 2026 a 02:31 am

Todays Important Key Figures 10 Jan

Today’s important economic data releases – a snapshot of key indicators influencing markets and shaping financial expectations.

January 09, 2026 a 11:00 pm

Todays Important Key Figures 09 Jan

Today’s important economic data releases – a snapshot of key indicators influencing markets and shaping financial expectations.

January 09, 2026 a 07:00 pm

GBPAUD: Fibunacci Level Technical Analysis

GBPAUD: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 09, 2026 a 05:08 am

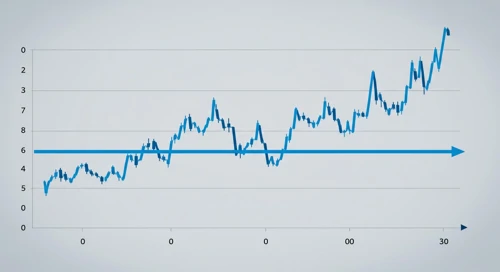

USDCHF: Trend with Support and Resistance Levels

USDCHF: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 09, 2026 a 04:28 am

Todays Important Key Figures 08 Jan

Today’s important economic data releases – a snapshot of key indicators influencing markets and shaping financial expectations.

January 08, 2026 a 07:01 pm

EURJPY: Fibunacci Level Technical Analysis

EURJPY: Fibonacci retracement levels to identify key potential support and resistance zones, based on recent price trends.

January 08, 2026 a 05:08 am

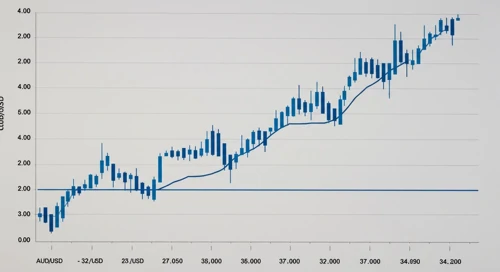

AUDUSD: Trend with Support and Resistance Levels

AUDUSD: Current price trend is evaluated alongside key support and resistance level. View of potential turning points and price momentum.

January 08, 2026 a 04:28 am

Currencies