The Best Broker Overall (Broker review 2022)

by SMO Team

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to me at no cost to you if you decide to purchase a paid plan. These are products I’ve personally used and stand behind. This site is not intended to provide financial advice and is for entertainment only. You can read our affiliate disclosure in our privacy policy.

Whether you trade rarely or daily on the exchanges, with the variety of platforms you can find the right one for you at Interactive Broker. From the simple and intuitive mobile app or web interface to very specialized apps for professionals, IB has a very wide range of features. Especially for professional investors and traders, Interactive Broker offers special tools, which implement your special wishes and requirements with numerous setting options.

Whether you trade rarely or daily on the exchanges, with the variety of platforms you can find the right one for you at Interactive Broker. From the simple and intuitive mobile app or web interface to very specialized apps for professionals, IB has a very wide range of features. Especially for professional investors and traders, Interactive Broker offers special tools, which implement your special wishes and requirements with numerous setting options.

Interactive broker (IB) is in our comparison the broker with the largest offer and the lowest costs.

★ 5.0 / 5

Have you always wanted a broker that meets all your needs? Do you want to have a broker that will continue to support your development in the future. Constant innovations and improvements are the hallmark of IB. Low cost structures and a wide range of expertise support your financial performance.

Interactive broker (IB) is for us one of the best brokers for professional investors and traders.

Let's take a look at what Interactive brokers offers.

General information

IB is one of the leading brokers in the world. IB has only been offering its services to private clients for a few years. Interactive broker (IB) was founded in 1978 in New York and currently has over 135 locations in 33 countries.

Platforms

IB offers various platforms for professional trading. For a high degree of flexibility, IB goes different ways.

Different platforms are offered:

- Web

- Mobile

- Desktop Software

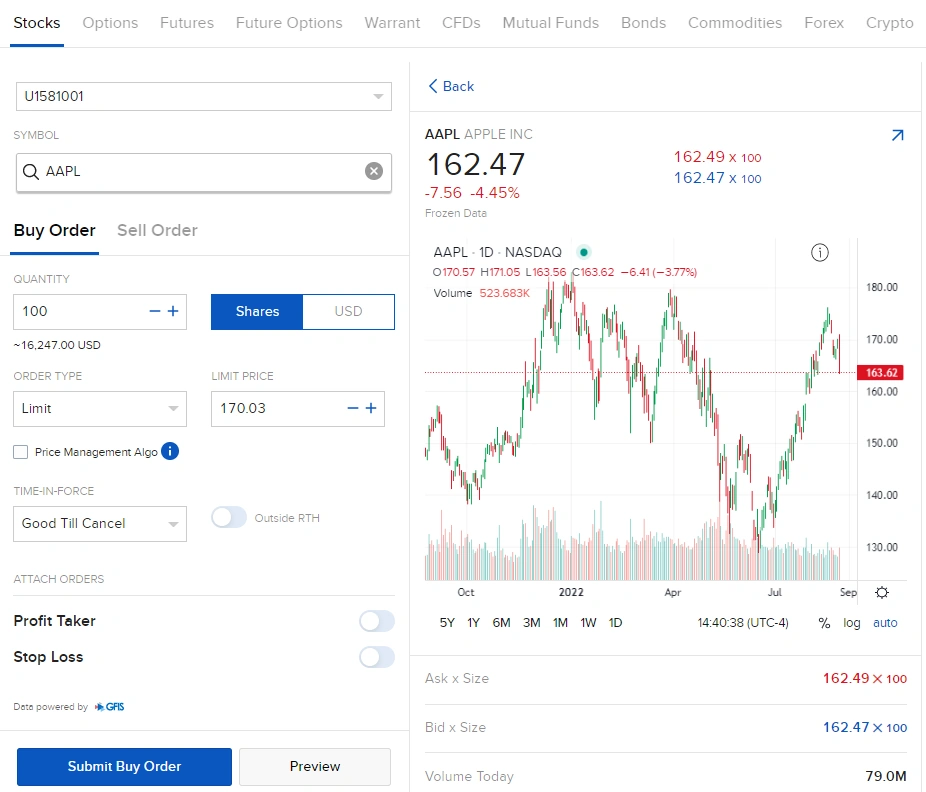

WEB

The web interface of IB offers numerous functions. This offers numerous functions for managing the portfolio, extensive reports and evaluation options, as well as a trading interface with which they can easily buy and sell positions.

MOBILE

IB offers four mobile apps.

- IBKR GlobalTrader

- IBKR Mobile

- IBKR Mobile for Tablets

- IMPACT by Interactive Brokers

IBKR GlobalTrader offers an intuitive and simple interface to manage one's portfolio and open and close positions. This app is suitable for beginners and people who do not implement many actions on the stock market.

Through the IBKR Mobile App, all the features of the IBKR GlobalTrader App functions are available to you. Furthermore, you can use screeners to search for stocks other financial instruments, create and manage watchlists and of course trade all instruments like stocks, ETF, options, bond, etc. without any problems. You can read financial news, set up alerts and learn more about the research functions in the app. The IBKR mobile app is suitable for beginners and advanced traders alike.

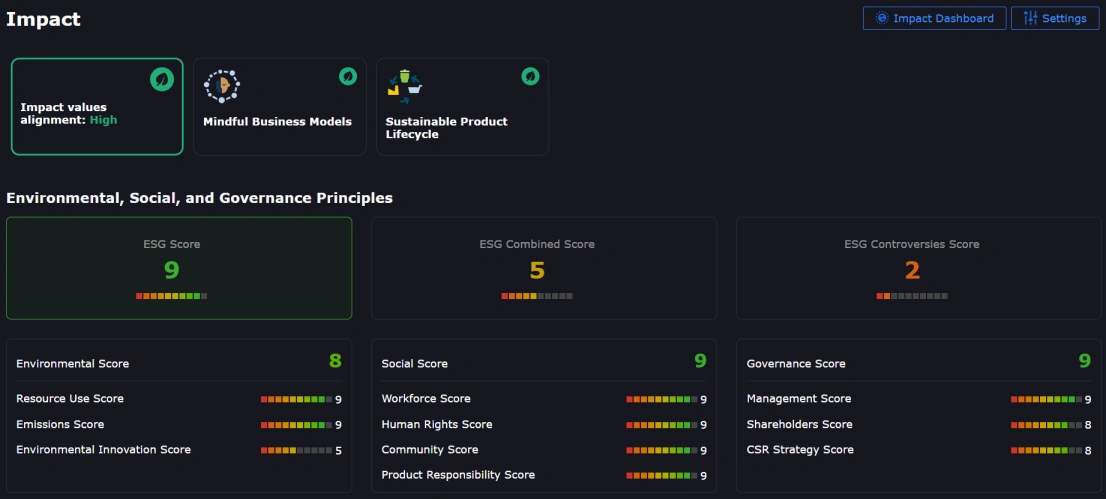

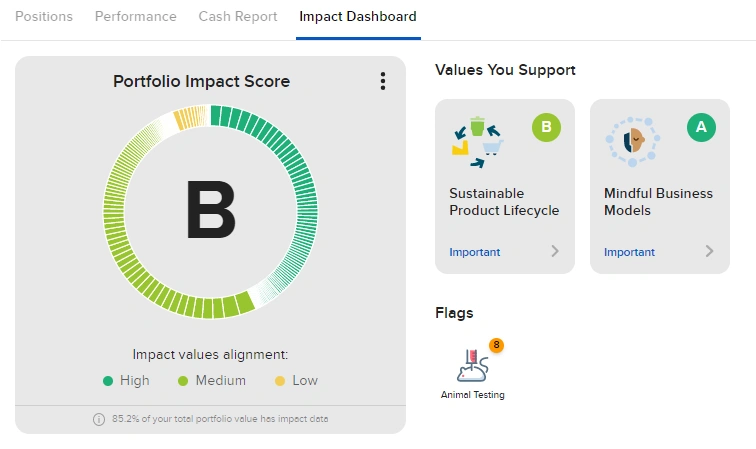

The IMPACT by Interactive Broker app helps you manage your sustainability criteria for your investments. You can configure the ESG criteria that are important to you. The app shows you the details of how "sustainable" their current portfolio is. You can also search for companies based on ESG criteria and you will also be informed about changes in sustainability ratings.

Software

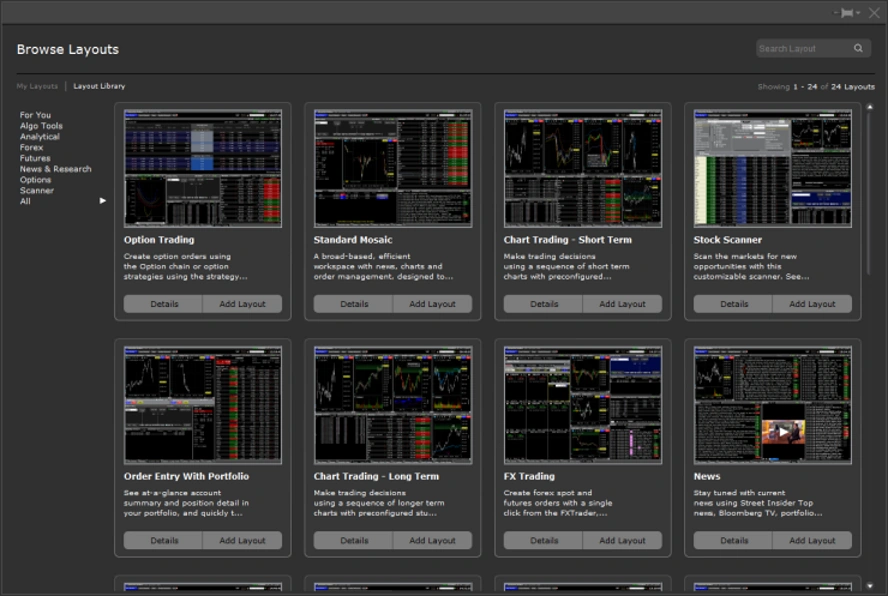

The main application of Interactive Broker is the TWS platform. In this, two concepts are offered, which can also be combined with each other.

The first concept is the Trader Workstation Mosaic view. In this view you can arrange the components you need clearly as a view. You get everything displayed as compressed as you want. Multiple views are possible.

The second concept within the Trader Workstation is the provision of numerous special tools, which offer you as a professional trader all the functions you need. These are tools for options or bond trading. There are also additional tools for arbitrage traders. News can be filtered to their needs with their own search rules.

The Trader Workstation is our favorite platform because it offers a very wide range of functions and is easy to use.

The TWS has tabs, similar to Office Excel, which allow you to define different views and add-ons per tab. When you create a new tab, you can choose from over 20 tab templates. Each tab can be customized at any time according to your needs and requirements.

Chart software

Interactive Broker always offers charting software in all tools. In the charts, a position can be opened or closed directly. In total, over 120 different indicators are offered in the charting software.

It is very flexible and scalable with powerful customization options. It integrated trading with over 120 technical indicators and chart studies.

You can trade directly in the chart and set alerts.

If you have a stock in your portfolio and open a chart of the stock, you will see the entry level and trades in the chart.

From our point of view, the charting software offered by IB is very good for normal needs.

However, who wants to use a professional charting software is not limited here. Because IB supports numerous third-party providers of charting software via its API.

Possible providers are for example: Ninjatrader, Sierra Chart, Tradingview or Multichart.

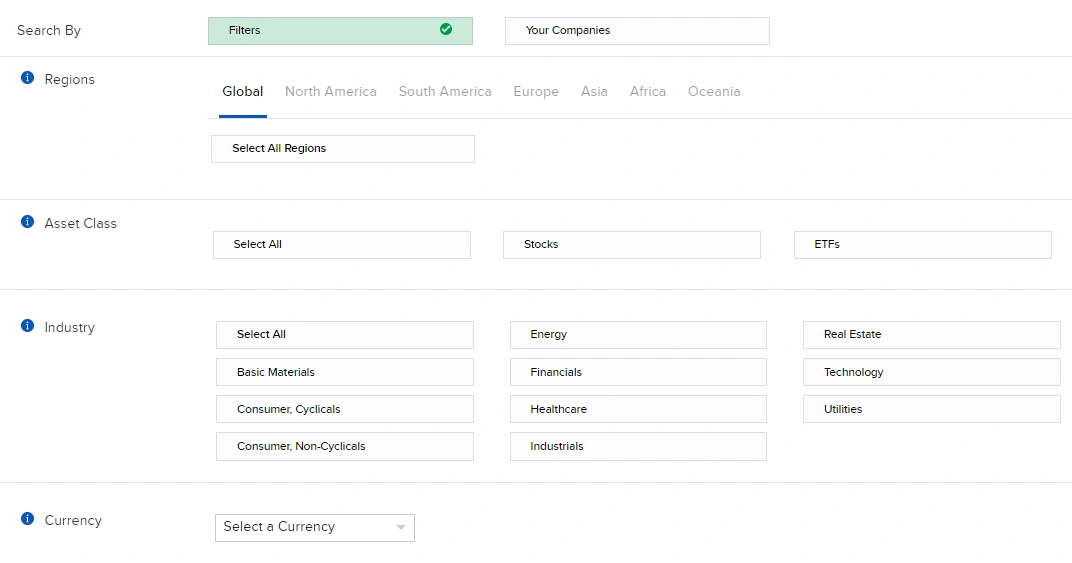

Market Screener

With the "Market Screener" IB offers a very powerful screener. This screener offers numerous screening templates with which you can find your relevant search results with just a few clicks. Of course you can save each template with your changes or save completely new search queries.

Another screening tool is the IBKR GlobalAnalyst. With this tool you can filter for companies with certain fundamental characteristics.

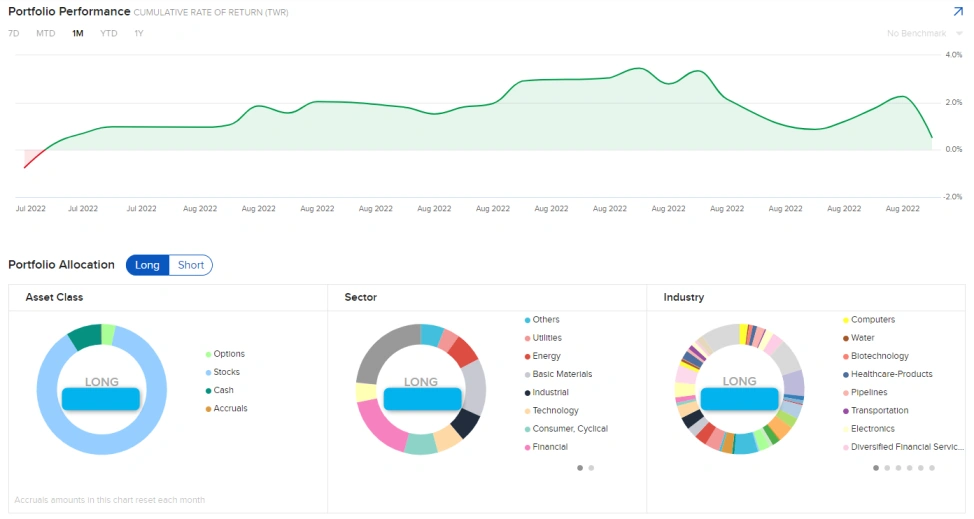

Reporting

IB offers a combination of predefined reports and a flexible report generator.

The basis of the reports is the "Portfolio Analyst" which gives you a good overview of your portfolio structure as a dashboard. It also shows you all historical data for transactions, deposits and withdrawals, credit card usage and much more.

The reporting platform is very comprehensive. If this is not enough for you, you can use RESTFul API to query and process the data according to your needs.

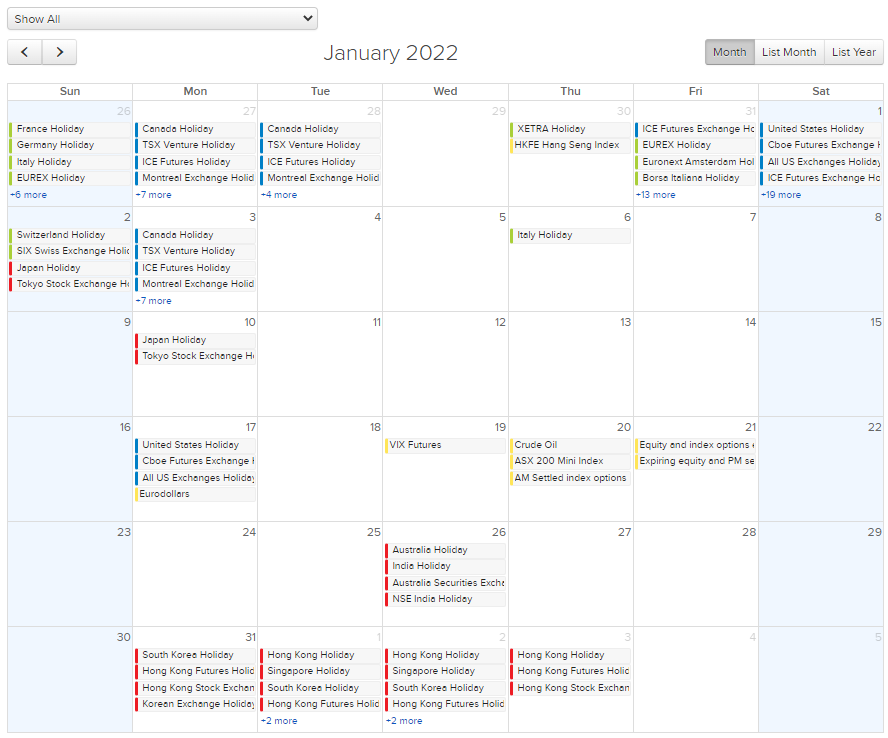

Calendar with financial events

Interactive Broker (IB) provides a calendar where you can see financially relevant events. It differentiates between economic data and fundamental data of companies that are in your portfolio.

This calendar is very helpful if you want to get an overview of relevant events.

You can also find the same calendar in IB's TWS software.

Alerting

Interactive Broker (IB) allows you to set up various types of alerts. The alerts can be saved with additional rules.

The Alerts are displayed to you in IB's platforms. If you wish, you can also receive alerts as an email or even as an SMS.

We always recommend using alerts if you do not want to miss special situations or if you trade a lot of stocks.

Account types

IB offers several account types. Among them are 'Individual', 'Joint', 'Trust', 'IRA' and 'UGMA/UTMA' accounts.

On the IB website you will find a guide and assistance for choosing the right account type.

IRA and UGMA/UTMA Accounts are for US tax residents only.

All outher Account Types are for institutionals or family offices.

Research

IB offers several research sources in its platform. You can find out more about them in the chapter on third-party providers.

IB also provides an overview of upgrades and downgrades in equity research.

Integrated services from external providers

If you as an investor or trader want to use services of third party providers, this is easily possible with IB. The prerequisite is that the provider offers its service on the IB Marketplace. Currently there are over 1600 offers available on the IB Marketplace.

The list of providers is very extensive. The providers offer their services partly for free and of course also for a fee. Offered are analyses, research, investment services, trading strategies and much more.

With IB Marketplace you can access countless information within one platform. This makes work much easier and is very helpful in times of data overload.

We appreciate the IB Marketplace very much.

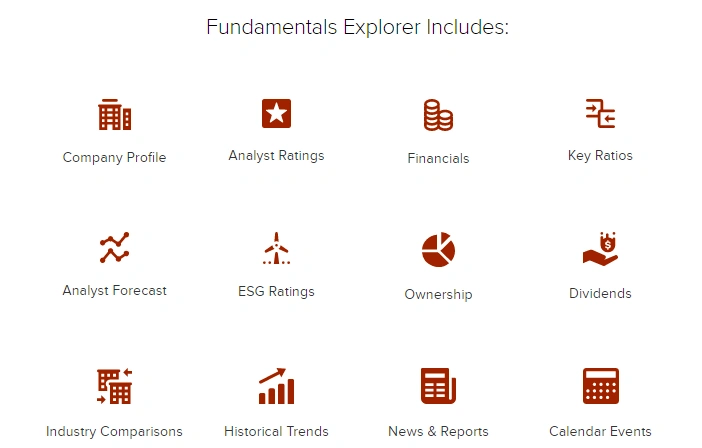

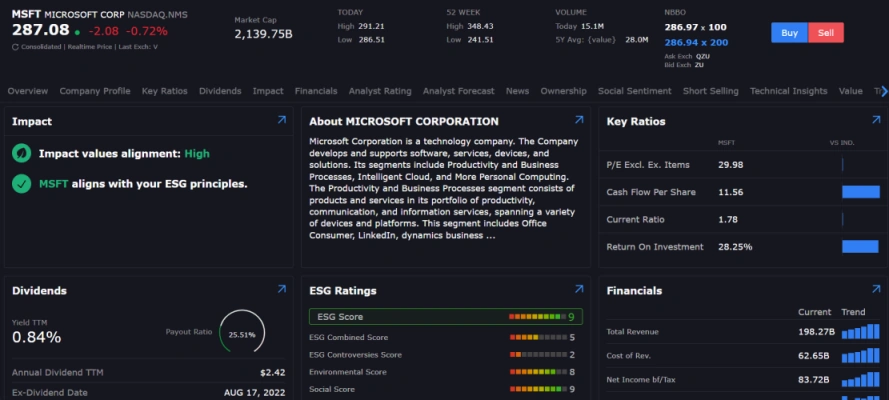

Fundamental data of companies

As an investor you are strongly interested in the fundamental development of companies. IB is one of the few brokers that provides you with comprehensive fundamental data of international companies.

The fundamental data are very comprehensive and clearly presented.

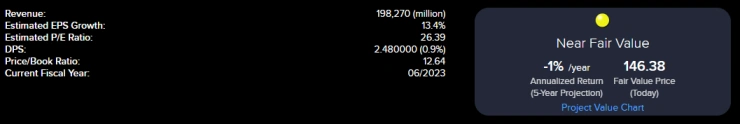

The following image shows an overview of the available data. Because the offer is constantly developed further, the picture is unfortunately no longer completely current. For example, sentiment data is also offered.

You can view the fundamental numbers of each stock and its performance. IB has also built in its own ranking (Portfolio Impact) for the quality of fundamental stocks, which can help you evaluate the metrics.

Additionally, ESG data is also displayed to show you how sustainable your investment is. IB even offers an additional app (IMPACT by Interactive Broker App) that shows you when a company's ESG ranking has changed.

With the IBKR GlobalAnalyst tool, you can filter for companies with certain fundamental characteristics. IB also offers a tutorial video for the IBKR GlobalAnalyst.

What can you trade?

IB offers everything the investor and trader's heart desires. From stocks, ETFs, options, commodities, mutual funds, bonds, CFDs to penny stocks (OTCCB) and crypto currencies, it's all there.

This is where IB's innovation comes to the fore. After all, Interactive Broker was one of the first professional brokers to offer crypto trading.

Options trading

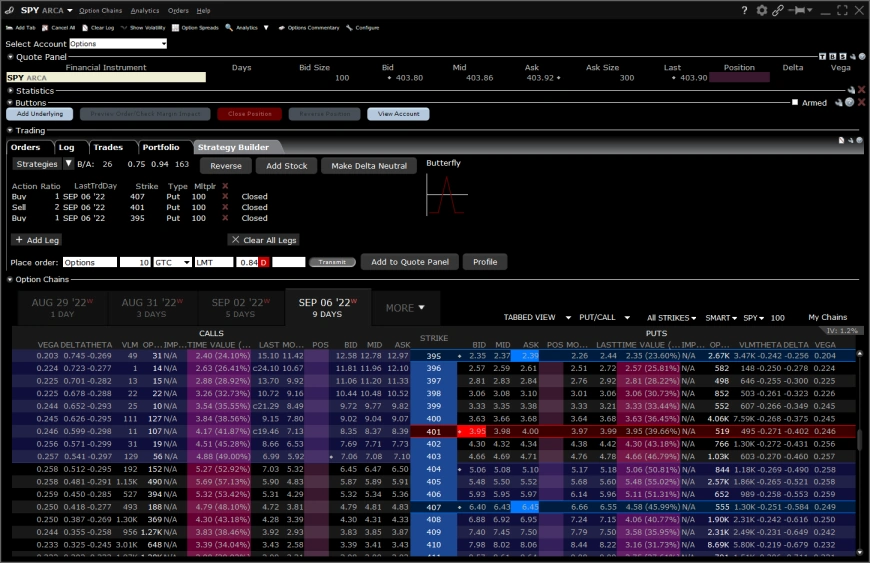

As usual at IB, the tools for options trading are offered several times. The basis for option trading is the "OptionTrader" in which you can find the option chain and enter orders directly.

The option chain can also be called up as a popup window for each stock or future. In the Mosaic view, the option chain can also be integrated as a SnapIn.

Options can also be traded in the Webtrader and in the IBKR Mobile App.

The management of complex positions (several options as one position) is particularly well realized.

Complex positions can be easily assembled. When you change a complex position, IB automatically recognizes the new structure and offers the complex position.

An indispensable tool is the Volatility Lab. With this, historical implied volatilities, the skew and other useful data can be displayed.

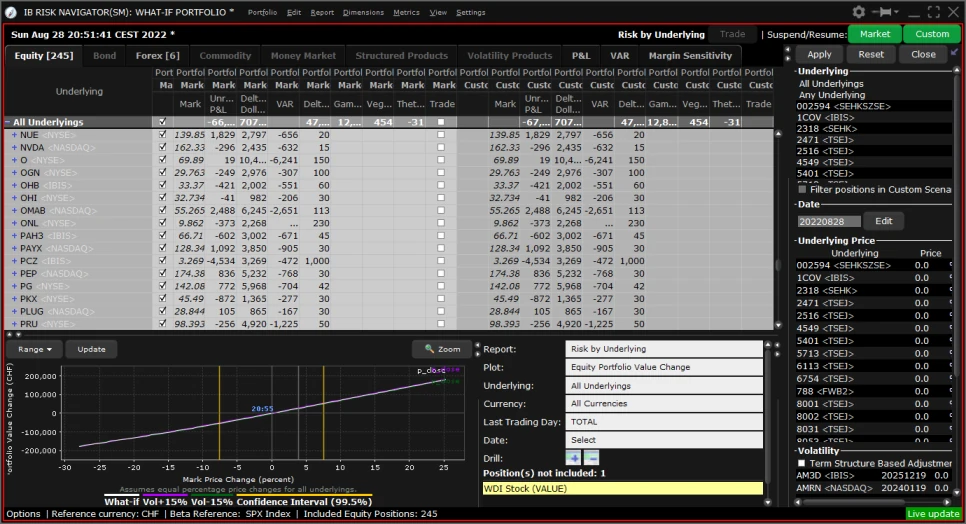

A very helpful tool, which can be used not only for options trading, is the "Risk Navigator - What if Portfolio" tool. With this software you can simulate the portfolio performance if the market would move positively or negatively. This tool shows you the risk in your portfolio. You can easily simulate what gains or losses would occur by adding positions or changing position sizes. The Risk Navigator is indispensable for risk management.

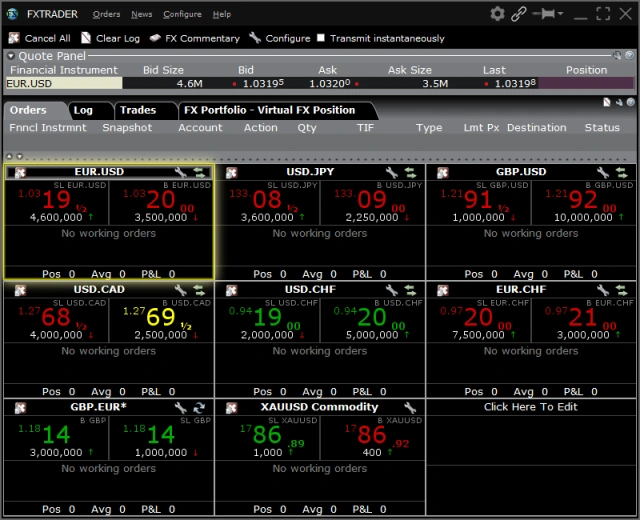

Currencies

IB offers a very wide range of different currency pairs for trading. The transaction costs for trading the currency pairs are very low (as usual with IB).

You can manage your account in any currency you wish. Currently (2022) there are 24 currencies to choose from. For example, if you live in Europe, you can keep your account in Euro or Swiss Franc.

A special feature of IB is the currency conversion when trading in foreign currency instruments. For example, if you have your account in USD and buy a stock in Europe, you will be charged the purchase amount in EURO. IB does not automatically exchange USD into EURO for this action. You can do this exchange on your own. The advantage of this is that you do the exchange only when you want to. For example, if you already have enough credit in Euro, an exchange is not necessary. With this procedure IB saves costs for the currency conversion, which benefits us as customers.

Fractional Shares

IB offers trading with fractional shares. However, this feature must be enabled in the account settings.

Basically, we think that fractional shares are not a good idea. You cannot trade fractional shares on the stock exchange. The broker allows you to use this functionality by trading fractional shares directly with the broker. However, the order is not forwarded directly to the stock exchange. So in case of fractional shares, the question arises, what do you own? The company does not know you as a shareholder. Only the broker knows that you have a fractional share in your securities account.

The offer to be able to trade fractional shares is an invention of brokers with a focus on private clients, such as Etoro. More professional brokers offer this service in our view only to get a good rating in the broker comparison.

Access to international stock exchanges

IB is a broker with access to international stock exchange trading. This is not a given compared to other brokers.

With IB you have access to more than 150 global markets. Of course, you can also manage your account in the currency of your choice. There are over 24 currencies available.

Interactive Broker offers access to almost all international exchanges. When you open the list of available exchanges on the IB website, the list is very extensive.

For example, if you want to trade options or stocks in Canada or in Europe, or if you want to buy foreign stocks directly on their home exchange (which we highly recommend, see "Foreign Stocks (ADRs)"), this is no problem with IB.

You also get access to real-time data of foreign exchanges.

If you are an investor and trader always looking for the best opportunities in the market, you need to rely on international exchanges.

Portfolio-Management

Portfolio management software usually allows you to manage your investments and analyze your portfolio with a variety of tools. Interactive Brokers customers can currently request integration with third-party portfolio management software providers.

The list of providers is large. If you are interested in a portfolio management offer, you are sure to find a suitable provider on the IB website.

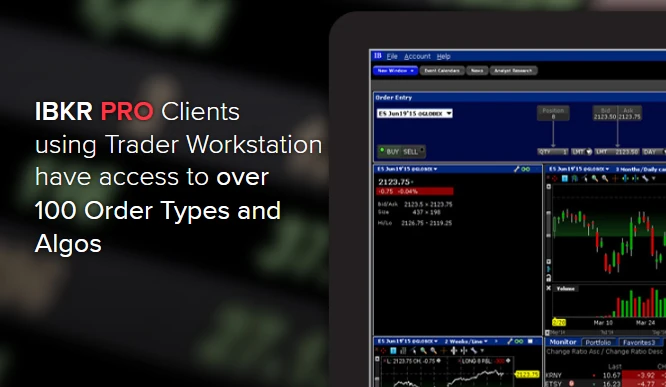

Order types

Using different order types, can give you an advantage as a trader.

IB offers over 100 order types. This is a lot compared to other brokers. If you use special order types, you will surely find them at IB. We ourselves have been inspired by the high variety of possibilities to implement one or the other trade with a special order type.

Every order and almost every order type can be assigned with additional rules. If you want an order to be active only when, for example, the S&P500 is above a certain level and at the same time the time of day must be older than 3pm, you can easily set this at IB.

If you want to execute orders in an optimized way, you can use IB's pre-made order algos. IB currently offers over 13 different order algos.

A few examples are the following algo orders:

- Volume-Weighted Average Price (VWAP) - Best Efforts Algo

- Dark Ice Algo

- Close Price Algo

- Arrival Price Algo

- Adaptive Stop Limit Algo

- Adaptive Algo

- Accumulate/Distribute Algo

Spread Quality

What is a spread? A spread is the difference between supply (bid) and demand (ask). The size of the spread determines how much the broker earns on each traded transaction.

It is not so easy to compare the spreads of brokers because the spreads vary in size depending on the market situation. That is, in normal stock market times, spreads are usually very small, which is very good. But in stressful stock market times, such as the first month of the Corona crisis, the spreads are very high.

We can only reflect our own experience here. From talking to other investors and traders, we know that IB offers very tight spreads. Of course, spreads at IB also widen when exchanges are in stress mode. But these are very small compared to other brokers.

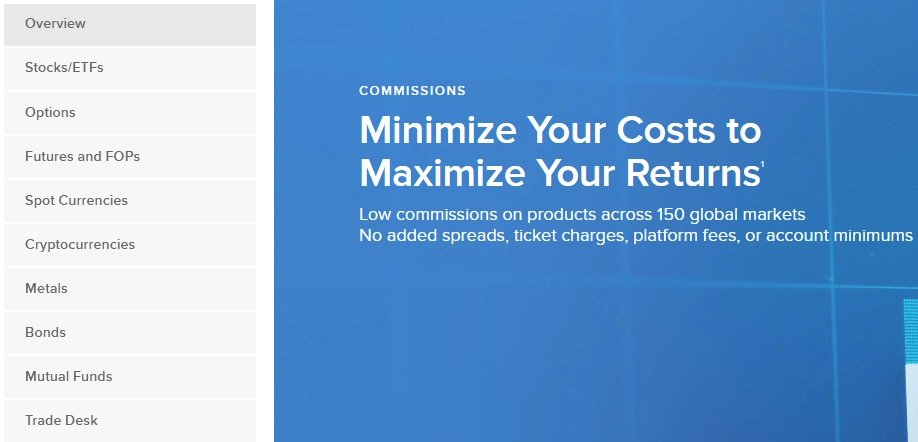

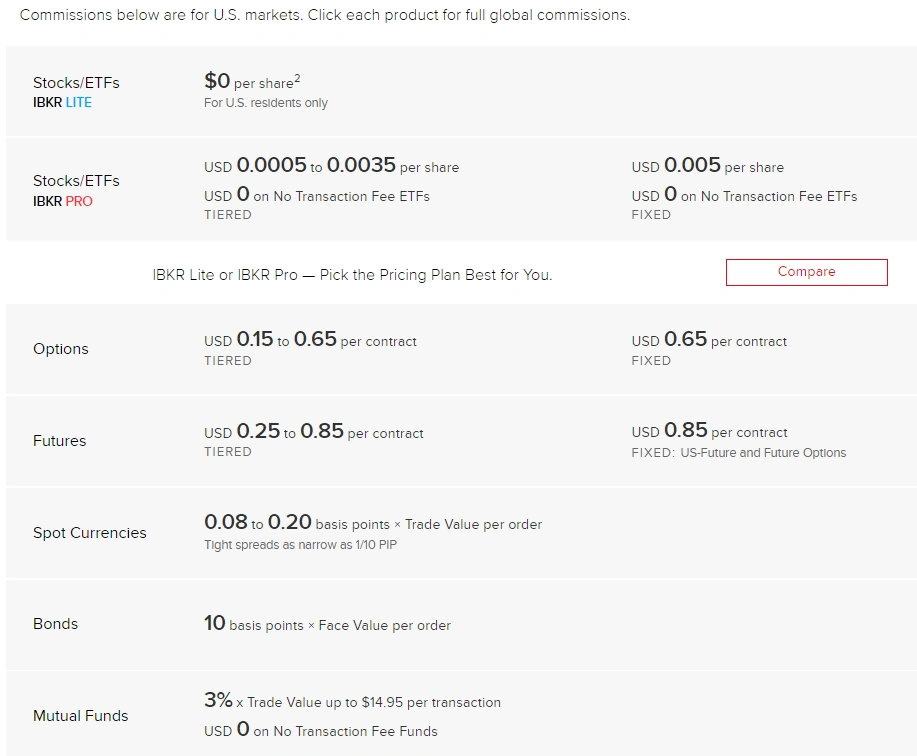

Costs

IB advertises itself as the broker with the lowest costs in the financial industry. And yes, when you look at the offerings of comparable brokers, you quickly find that IB has the lowest total cost of ownership.

Commisions: IB offers the lowest cost for buying and selling positions.

Maintenance Fees: IB does not charge maintenance fees (if you have another broker, read the small print).

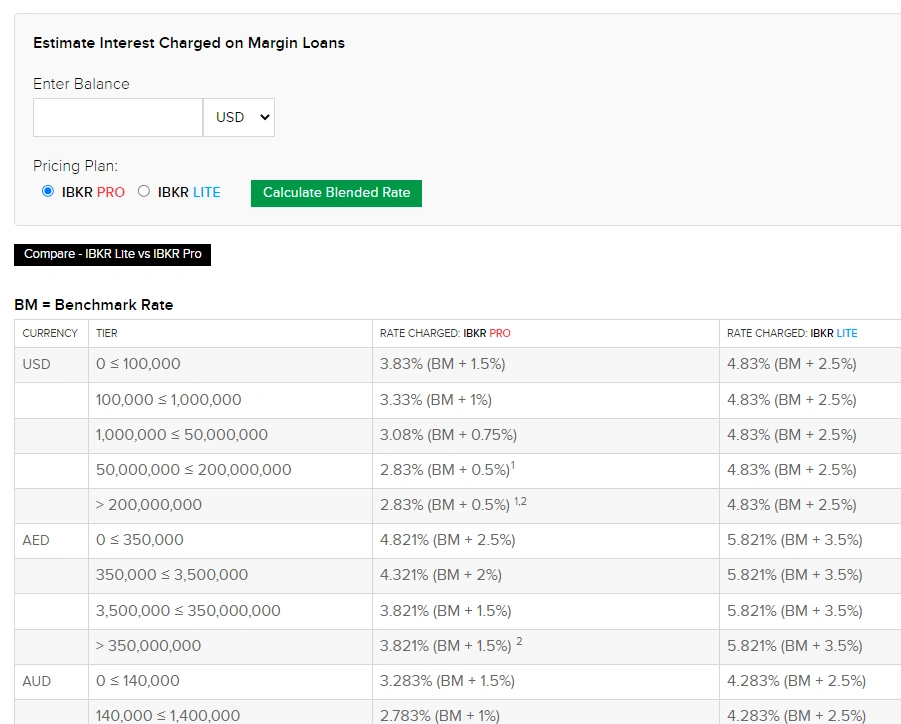

Margin Interest: Trading on margin also incurs a cost (interest) on the amount you borrow from the broker. IB offers by far the lowest interest/margin costs in the broker comparison.

Here is an excerpt from the August 2022 US Fees.

IB offers two plans

The first plan (IBKR Lite) is for private investors and traders with a small budget, which includes $0 commission on all US listed stocks and ETFs.

The second plan (IBKR Pro) is for sophisticated investors and traders who trade a lot and always want the best execution.

If you need more details about IB's costs, you can find them directly on IB's website. In the main menu you will find the entry "Pricing".

An important point to note about costs is that competitors offer trading US stocks for free. In 99% of these offers, the orders (order flow) of the customers are resold to third party providers. The broker then only has a forwarding function and no longer implements the classic functions of a broker. This means that these brokers can no longer ensure at what price the orders are executed. For the end customer, this means that your orders are usually executed at a worse price than if the orders are forwarded directly to the exchange, as is the case with Interactive Broker.

Earn Interest

For cash (uninvested capital) you get paid depending on the interest rate of the currency. For example, if you have USD in your account in August 2022, IB will pay you an interest of 1.83% per year.

Large order volume - Order Desk

IB supports institutional and also private clients with high order volumes.

When you place large orders with IB, you will receive a message from the OrderDesk that you can execute these orders through IB's OrderDesk traders. These traders will then try to get the best possible price for you. This is how IB maintains its high volume customer relationships.

From experience we know that you will receive such requests for example from an order size of 500 SPX options.

If you want more information about this, you can find it on the Interactive broker website under the rubrick "The IBKR Block Trading Desks".

If you want to execute high volume orders yourself, you can use IB's pre-made order algos. Read more in the Order Types chapter.

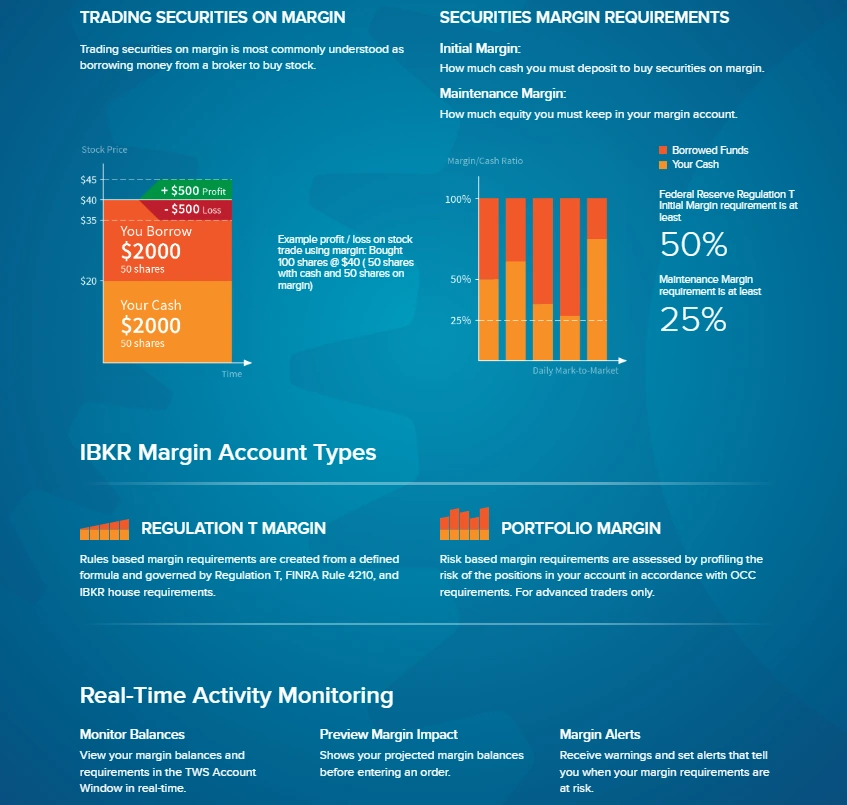

Trading on Margin

IB offers a margin account for professional traders and for accounts with a minimum size of $110,000. With a margin account you can invest more money than you have available in the account. If you use this option, the amount you have used more than your account size will be charged to you as a loan with interest. IB has the lowest interest costs in the broker comparison.

Trading on margin incurs costs (interest) for the amount you borrow from the broker. IB offers by far the lowest interest/margin cost in the broker comparison.

Current comparisons can be found on the IB website with the keyword 'comparerates'.

We would like to mention here that trading on margin is only suitable for experienced traders and investors. They increase their risk by trading on margin.

API

IB offers one of the best and most comprehensive APIs available in the broker environment. IB offers three different APIs.

IB offers three APIs.

The first API is an industry standard RESTful API that allows you to place orders and get all the data about your account. This API can be used with all programming languages that can handle JSON formats.

You can use the api in diverent programing languages.

![]()

The second API is the TWS API, which provides you with all the functions of the Trader Workstation. This interface can be accessed with the following programming languages.

As part of the TWS API you also get an Excel API interface.

The third API is the FIX API. This API is offered in the form of an industry standard primarily for institutional customers. This API offers special functions in highspeed trading and order routing. As a private investor or trader you will hardly get access to this API.

IB offers a newsletter for API and Quant traders.

Discussion themes include IBKR API, deep learning, artificial intelligence, Blockchain and other transformative technologies converting new markets. dialogues catching R, Python and other popular programming languages constantly include sample code to help you develop your own analysis.

Even if they don't have programming skills, this API is extremely helpful. The quality of the API determines how many third-party vendors can connect their tools to the brokers' data. The better the broker API, the better the third-party tools.

For example, if you use a charting tool like Ninjatrader, Sierra Chart , Tradingview or Multichart, they can connect it to Interactive Brokers data streams. Of course, the third party tools can also be used to create orders and reports from IB.

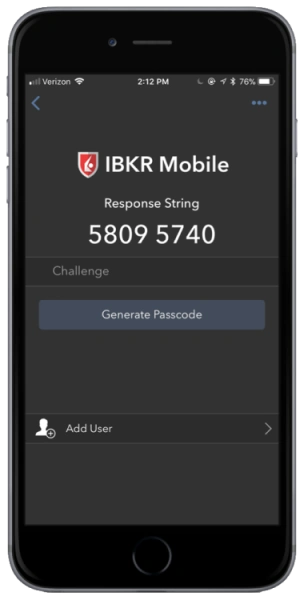

Authentication

IB is always well protected when it comes to security issues. IB offers two component authentication.

With the IB Authentication App, you can log in securely at any time.

Support

IB Support has two areas.

One area helps you with general questions like account opening, currency exchange and general deposit settings.

The second area is active exchange traders in OrderDesk. When you talk to one of these traders, they immediately realize that they need to get to the point quickly. Time is money. These traders are very knowledgeable. We have always been helped satisfactorily in the last few years.

You can communicate directly by phone and find numerous "how to" articles and extensive explanatory video.

Further information and know-how can be found on the website in the training section.

Education & Knowhow

IB offers a large selection of learning videos directly on the website or on their YouTube channel.

On the website there is the IBKR Campus where you can find different streams. Currently the following offers are available:

- Traders Academy

- IBKR Webinars

- Traders Insights

- Traders Insight Radio (Podcast)

- IBKR Quant

- Studend Trading Lab

Depending on your level of knowledge, you can get more information there. The offer is constantly being expanded.

Credit Card

Interactive Broker offers a debit mastercard. There are no monthly fees or interest on late payments. Credit can be repaid at your own pace.

Summary

Interactive Broker (IB) is the best broker for us. It is a leader in costs, providing innovation, tools, apps and data. Very good research is offered and the education section is top.

All outstanding features are:

- very low cost structure

- extensive platforms and software

- very wide range of financial instruments

- very good platform for stocks, ETF, futures, bonds and options trading

- international stock exchange access

- numerous news feeds

- fundamental data of companies

- Comprehensive screener

- calendar with financial events

- integrated services of external providers (very extensive)

- additional tools for high order volumes

This list is not exhaustive. But the listed points are exactly the criteria you need as an investor or trader.

IB is for us the most flexible broker on the market. If there is a problem or you have a special request, with IB there is always a solution.

If you open an account through our link, you will receive $1000 worth of Interactive Broker shares as a gift.

★ 5.0 / 5

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to me at no cost to you if you decide to purchase a paid plan. These are products I’ve personally used and stand behind. This site is not intended to provide financial advice and is for entertainment only. You can read our affiliate disclosure in our privacy policy.