A very strong trend in COST shares Seasonality Stock Chart: Over 95% Profitable

by SMO Team

Seasonal chart analysis from COSTCO WHOLESALE CORPORATION (COST)

Are you looking for a good opportunity in a rising stock? The recurring positive price trend of the COSTCO WHOLESALE CORPORATION (COST) shares in recent years has had a very high hit rate. The price development in the analyzed period shows a very good risk/reward ratio.

The COSTCO WHOLESALE CORPORATION (COST) shares are starting a very strong seasonal trend.Over the last 21 years, the price trend repeated itself in the analyzed period with a hit rate of 95.24%.

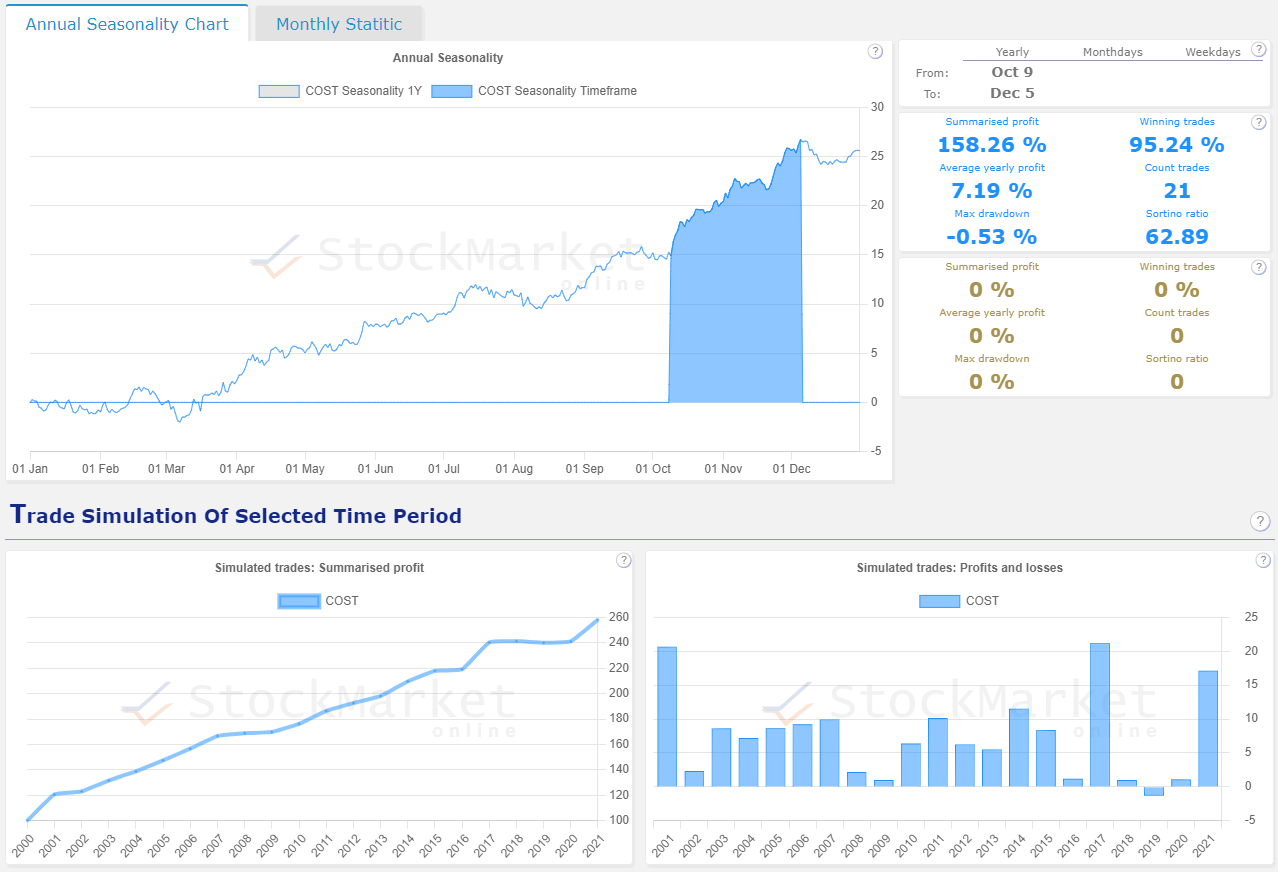

Seasonality Chart - KPI Overview

The following table shows all the key figures of this analysis.

If the share was bought over the last 21 years at the beginning of the analysis period and sold again at the end of the period, the following key performance indicators (KPIs) for the performance of the trades would result:

| Company | Summarised profit |

Winning trades |

Average yearly profit |

| COSTCO WHOLESALE CORPORATION (COST) | 158.26 | 95.24% | 7.19 |

| Company | Count trades |

Max drawdown |

Sortino ratio |

| COSTCO WHOLESALE CORPORATION (COST) | 21 | -0.53% | 62.89 |

The Sortino Ratio of 62.89 for COSTCO WHOLESALE CORPORATION shows the strength of the seasonal trend in this analysis. The very high ratio shows the high stability of the profits.

Analysis

As the seasonal analysis in the following image shows, there is a strong trend in the analysed period.

In the following picture, the upper diagram shows the seasonal annual performance of the last few years. The seasonality chart below shows the simulated performance of the given period over all years. The bar chart shows the annual performance of the analyzed period.

You can view the analysis yourself by opening the following link.

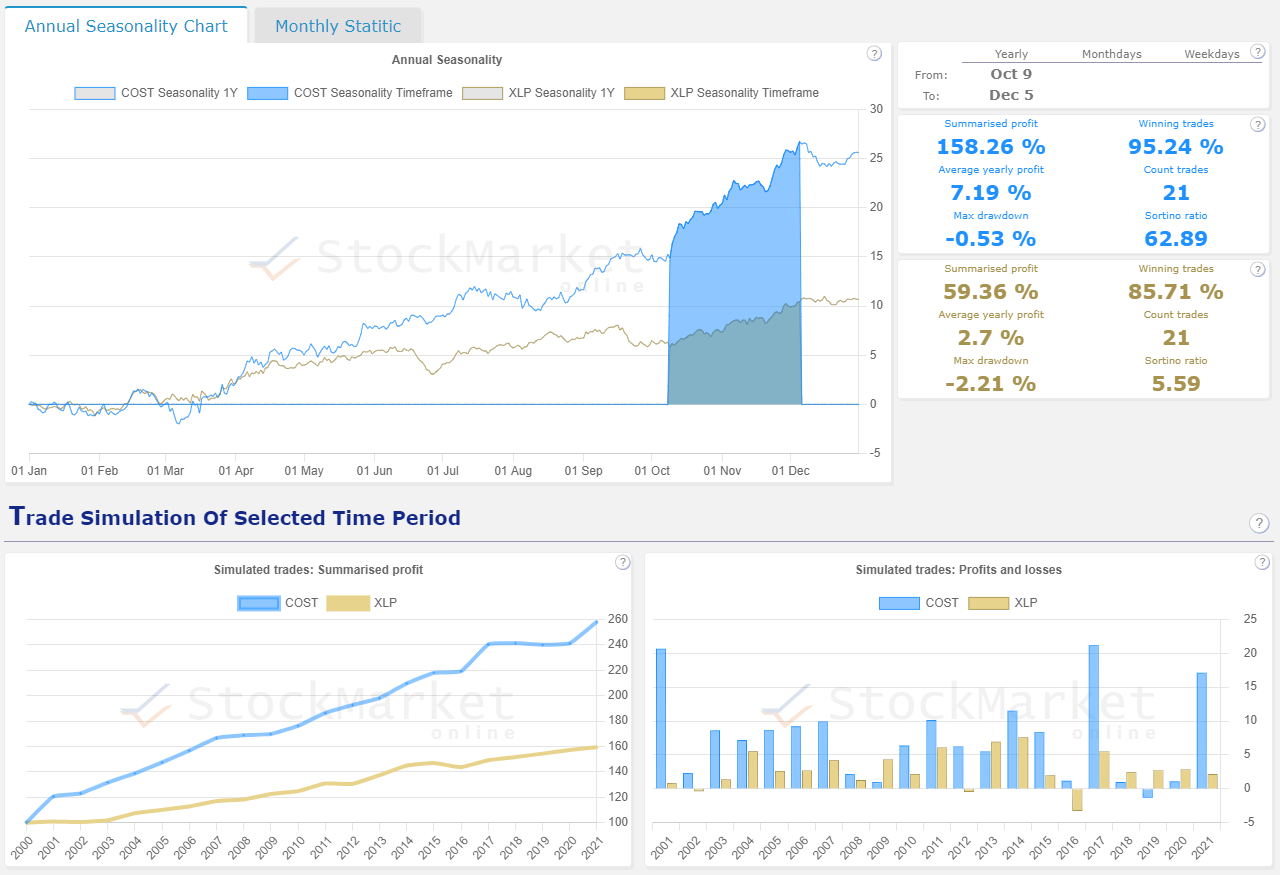

Compare: COSTCO WHOLESALE CORPORATION vs. Consuler Staples sector

You can view the analysis in the Saisonality Chart Analyzer.

The sector also has seasonal strength over the same time period, which increases the likelihood that the seasonal sattern will repeat.

Link Summary

Here you can find all the links to this article again.

| Open the Link | Link |

| Seasonal analysis of COSTCO WHOLESALE CORPORATION (COST) | Open |

| Compare: Seasonal analysis of COST vs. XLP | Open |

| Chart of COSTCO WHOLESALE CORPORATION (COST) | Open |

Summary

If you want to use seasonal trends, you should always watch the big picture of the market and sub-sectors such as sectors or regions. Seasonal chart trends are part of the market technique, and it works best in rising markets.

You can find more seasonal chart trends with our 'Seasonality Screener'. Numerous configurations and comparison options facilitate the 'Seasonality Chart Analyzer'.

If you have any questions or suggestions, please do not hesitate to email us.