Investing – Psychology

When psychology annoys us and becomes the biggest enemy of the investor.

Psychology is as complex as the number of people on our beautiful earth.

We would like to show a psychological effect that you may remember in difficult market phases and helps to keep a clear view on the markets.

Investors Principles

Actually, it is not necessary to write something about the psychology of investors. Because you and most investors know what points are necessary for long-term success:

-

Think long-term and invest long-term

-

Buy quality at fair prices

-

Do risk management

-

Do money management

But history shows that not all investors succeed in taking these principles into account at all times. Of course, this does not apply to you, but you surely know someone (maybe your neighbor) who has experienced this.

When stock prices are rising, it is not a problem to stick to your investor policy. But when prices fall over a long period of time and the mood in the stock markets is bad, some investors' attitudes change. The willingness to take risks is then no longer that of a long-term investor.

Psychological Effect

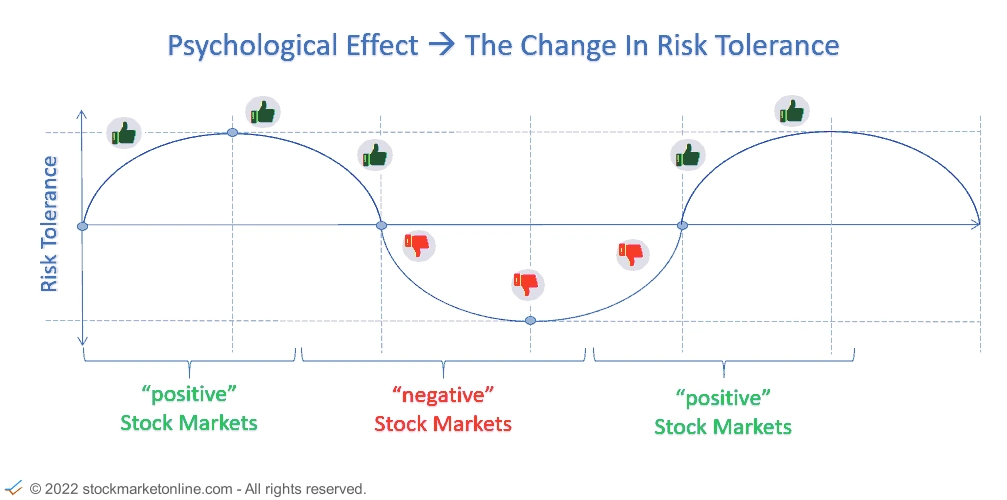

Unfortunately, some investors' risk tolerance changes depending on market sentiment.

When market sentiment is bad, it's hard to buy countercyclically against the general mood and your own feelings, such as fear or panic, when everyone else is selling.

Conclusion: Define your risk capacity. In doing so, also pay attention to your comfort zone. Permanent adherence to risk parameters is crucial, especially in difficult market situations. Good investors are not influenced by short-term market sentiment and the press. Those who buy quality are happy about lower prices.