Investing – Money Management - Cost average effect

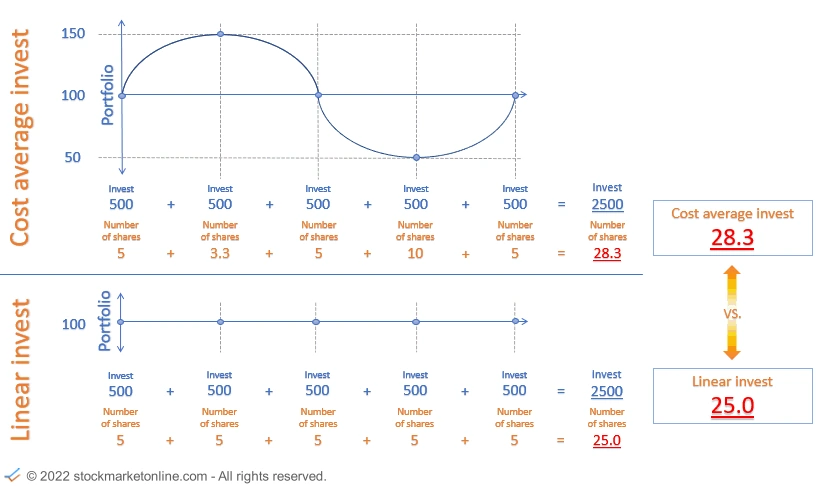

The cost average effect describes the summation of the number of shares that is created by investing a savings rate when prices fluctuate.

If equal amounts are regularly invested, the cost average effect generates a higher number of units, which in turn represent a higher value.

The cost average effect shows that volatility can contribute to positive portfolio performance when investing a permanent savings rate.

Cost average effect

The picture shows a portfolio development, which fluctuates over time and is back to the entry level at the end of the term.

If equal amounts are regularly invested, the cost average effect generates a higher number of units, which in turn represent a higher value.

With the cost average effect, price fluctuations are used to acquire more units.

It should be noted that this effect only works if the long-term development of the portfolio is positive.